1. BACKGROUND

This policy was created in order to comply with European Union (Shareholders’ Rights) Regulations 2020. (S.I. 81 of 2020) (The “Shareholders’ Rights Regulations”). The Firm is required to comply with applicable FCA rules, including those in COBS 2.2B transposing aspects of Article 3g of the Shareholder Rights Directive (SRD II) ((EU) 2017/828).

The Shareholders’ Rights Regulations require that an asset manager must develop, publicly disclose, and include the following in its Shareholder Engagement Policy as to how it:

Asset managers should also publicly disclose, free of charge on their website, how they have implemented any engagement policy (and include a general description of voting behaviour) along with:

2. POLICY

Blue Whale Capital LLP (“Blue Whale”) is an investment management company specialising in the management of global equity portfolios. Blue Whale is committed to delivering consistent significant outperformance for the Funds that we manage.

To achieve this aim, Blue Whale invests in, what we have determined to be, high quality businesses at an attractive price. In selecting investments for the portfolio, Blue Whale identifies companies from a broad range of geographies and sectors with no particular sector or style bias which, based on its analysis of company specific risk factors, including those related to Environmental Social and Governance (“ESG”) matters that might materially impact the business’s sustainable return on investment, meet the following criteria:

Approach to Engagement

Blue Whale believes firmly in the importance of effective stewardship and long-term decision-making, involving transparency of engagement policies between institutional investors and the investee companies. Blue Whale seeks to protect and grow investor assets by providing high quality investment management services to its investors.

Blue Whale’s engagement with issuers on behalf of our investors facilitates the responsible allocation and management of capital consistent with our Funds’ investment objectives. Engagement activities may include, amongst other things:

Blue Whale always endeavours to act in the best interests of our clients who have entrusted their savings to us but we neither hold ourselves out as activists nor do we aspire to be activist investors.

Voting with our feet

Our ultimate sanction, if we consider that a company is failing to meet our standards, will be to remove its shares from our Funds.

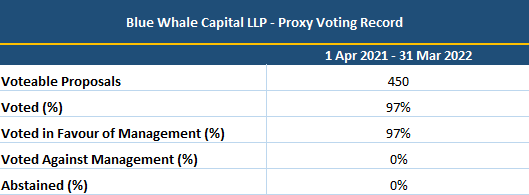

Proxy Voting

The primary consideration in the exercise of votes is the stewardship of investments held in the Funds and in which investors have an interest. The aim is to protect or enhance the value of those assets both in the short term and in the long term. Blue Whale operates a Proxy Voting Policy. We will normally vote all available proxies including those concerning routine corporate governance matters. We will normally vote with management unless we view a motion as running counter to our investors’ interests, examples of which might include changes in capital structure, mergers/acquisitions/disposals and senior management remuneration. Nonetheless, Blue Whale is pragmatic in assessing its voting strategy on any particular motion so we will consider our ability to influence the outcome based on the size of our shareholding and any cost to the Funds for voting. All voting decisions are made by the portfolio managers. We will provide relevant reporting on our voting history on our website.

Conflicts of Interest

Blue Whale operates a detailed Conflicts Management Policy and has a strong compliance culture. We seek to always act in the best interests of our clients and avoid conflicts. We also maintain a Conflicts Register. From time to time, a conflict or a potential conflict will arise. We will determine how we can best manage the conflict to ensure that the best interests of clients are met. If we are unable to manage a conflict of interest satisfactorily, as a last resort, we will disclose the conflict to the client/clients. If we identify a conflict in respect of a voting matter, we will not simply abstain from voting; we will seek to disclose such conflicts to clients and, where appropriate, obtain voting instructions from the clients.

Environmental, Social and Governance

Blue Whale, whilst not currently marketing our Funds as ESG funds, naturally incorporates the assessment of ESG factors in our analysis of companies as we believe that sound ESG policies and behaviour are inextricably linked to the survivability and long term sustainable growth and profitability of the companies in which we invest. As we aim to be long term investors, good corporate governance together with a progressive approach to social factors (including diversity) and the avoidance of environmentally damaging activity are important elements in our analysis and selection of suitable investments for the Funds. Whilst we are generally sector agnostic, our ESG standards mean that we avoid investing, for example, in coal mining and other industries with excessive deforestation and environmental degradation caused by pollutants. Similarly, we avoid investing in industries with poor labour relations. Thus, we exclude many rideshare or “gig economy” companies that shirk employer responsibilities by externalising employee costs in order to pass themselves off as “asset-light” businesses with limited labour obligations to justify higher valuations.

Blue Whale does not use the services of any proxy advisors.

This Shareholder Engagement Policy is subject to review at least annually.